Outsourced Tax Preparation Services for USA CPA Firms and Accounting Professionals

Tax season can be overwhelming for CPA firms, Enrolled Agents (EAs), accounting professionals, and small and medium-sized businesses. Keeping accounts, records, reports, and other documents compliant with taxation legislation can be time-consuming and complex. CrownGlobe offers top-tier outsourced tax preparation services to alleviate the burden of tax season, allowing clients to focus on onboarding more revenue-generating customers and offering them value-added services.

Simplify your tax preparation process with CrownGlobe's 80% lower investment and 150% faster turnaround time.

Our CPA tax preparation services help eradicate complexity and resources; otherwise, get engaged in checking/ matching tax details and preparing client returns. We make the convoluted tax calculation, preparation, and filing job more effortless for you with around 80 percent lower investment and 150 percent faster turnaround time.

Why Outsource Tax Preparation Services to CrownGlobe?

At CrownGlobe, we understand the importance of accurate and timely tax preparation services. Outsourcing tax preparation to us helps CPA firms and individual businesses leverage the benefits of accurate tax processing. Some of the benefits of outsourcing tax preparation to us include the following:

- Reducing stress, complexity, and taxation cost with process automation and a highly experienced team.

- Scaling up anytime to maximize benefits with our simplified models and short turnaround time.

- Covering tax calculation, return preparation, forms and certificate management, review, and filing services.

- Having expertise in all major tax preparation solutions to help clients choose the environment they like us to work in for smooth transition and streamlined supervision.

Let Crownglobe's CPA Tax Preparation Experts Handle Your Tax Season Stress

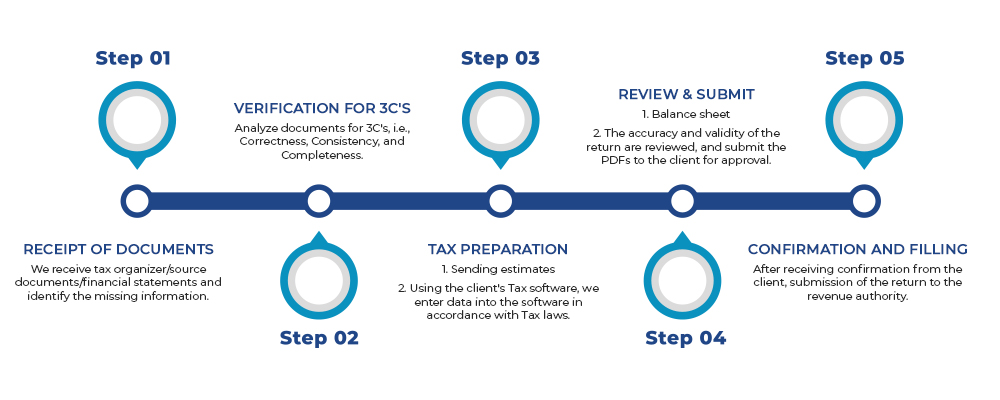

Our CPA Tax Preparation Process & Verification Process

At CrownGlobe, our CPA tax preparation and verification processes are designed to ensure our clients receive the highest quality service.

- We start with obtaining all the relevant information, current year's tax organizers, documents, and financial statements from the client via a secured file-sharing portal.

- After verifying the absoluteness of the data and completeness of the information and taking note of carrying forward balances, we analyze the balance sheet, profit & loss statement, and other relevant data received from the client to identify and correct any discrepancies before commencing the return preparation process.

- We then enter all the required data into the client's tax software.

- Lastly, we submit the tax returns and computation PDF files to clients for their comments, observation, and queries.

- Upon receiving confirmation from the client, we make all required corrections and initiate the filing process.

Our CPA Tax-Preparation Outsourcing Process includes the following steps:

We provide CPA Tax Preparation Outsourcing Services for the Following:

- Individual: Form 1040, Form 1040NR, Form 1040A, and Form 1040EZ.

- Partnership: Form No. 1065.

- Corporation: Form 1120, Form 1120A, and Form the 1120S (for statutory corporations).

- NGO: Form 990.

- Fiduciaries: Form 1041.

Our Highly Experienced Team Provides Year-Round and Year-End Tax Preparation Services to Meet the Tailored Needs of Our Clients

Our team at CrownGlobe is equipped with the advanced technology and software to deliver high-quality accounting services to our clients. We use a range of tax software, including Intuit’s QuickBooks accounting software, Intuit’s Pro-Series, Intuit’s Lacerte, Drake, Turbo Tax, ATX, and ProSystem fx ® Suite – CCH, to provide you with efficient and accurate results.

Empowering Your Financial Success with Precision And Security

At CrownGlobe, we understand the importance of maintaining the security and confidentiality of your data. We have implemented strict security measures to protect your confidential information. We encourage our clients to use private cloud servers to share their documents instead of public emails or cloud platforms. In case you do not have a private cloud platform, we offer our document management portal, where we create accounts for our clients. This portal allows us to assign different permission rights to our clients and team, ensuring that your data remains secure and confidential.

Let Us Crunch the Numbers While You Run The Show

Our sales tax compliance outsourcing services are designed to help CPA firms and businesses prepare and file sales and use tax returns across all states in the USA. With the ongoing pandemic, many companies have allowed their employees to work from home, leading to nexus issues with other states that require careful review from a sale and use tax compliance standpoint. Our sales tax compliance outsourcing services ensure you comply with all state laws and regulations, avoiding any possible penalties.

We offer a range of sales tax compliance services, including:

- Arranging standard paperwork explaining the taxable and gross sales and sales tax liability for every valid state.

- Organize sales tax returns, both online forms and manual PDA.

- Tracking resale certificates and maintaining supporting schedules that reconcile with your ledger.

- We keep track of all sales tax updates and notify our clients so that they may collect accurate sales tax from their end customers.

Our experienced professionals are always ready to assist you with your financial needs, ensuring your business runs smoothly.

Partnering for your Financial Growth

At CrownGlobe, we believe that the success of our clients measures our success, and we are committed to providing high-quality services that will help you achieve your financial goals.

Let us help you with all your accounting and financial needs. Reach us today to learn more about our services.